- Accounting means the systamatic way of recording ,reporting and analysis of financial transactions of a business.

- Accounting plays a very important role in each and every organisation.Because,managers has to know the gains and losses of a company.

Types of Accounting :

- Accounting classified into 3 types :

- Real Accounts.

- Personal Accounts.

- Nominal Accounts.

Real Accounts :

- The accounts which are related to the assets(tangiable / non-tangiable) called as 'Real accounts'.

- Tangiable :Tangiable means assets which are physically exists.

- Examples : Buildings,Vehicles,Machines,etc.

- Non-tangiable : The assets which are not physically not exists.But they have value.

- Examples : Goodwill, Trademarks,patents,etc.

Debit :What Comes In.

Credit :What goes Out.

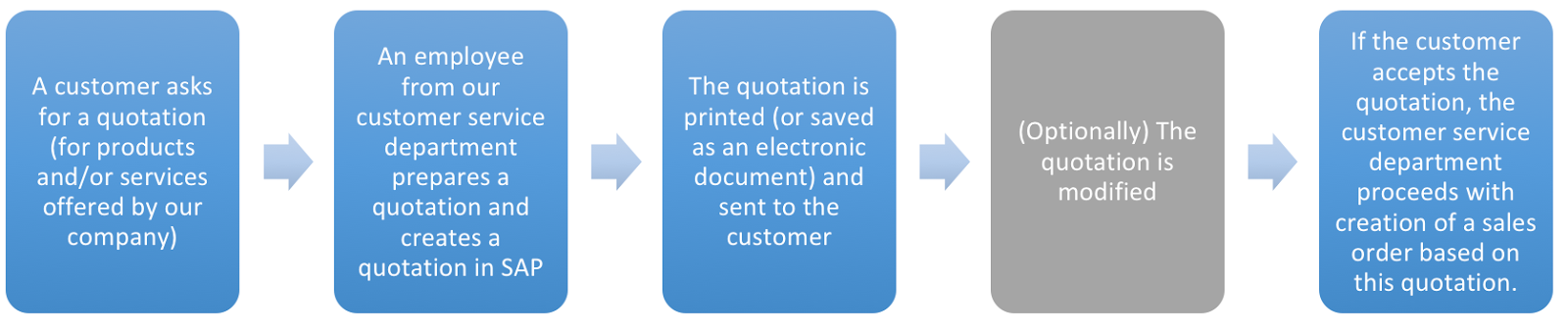

Personal Accounts :

- The accounts which releated to the persons or organisations called as 'Personal accounts'.

- Natural Accounts : The accounts which are related to the persons(living things) called as natural accounts.

- Examples :Humans,pet animals,etc.

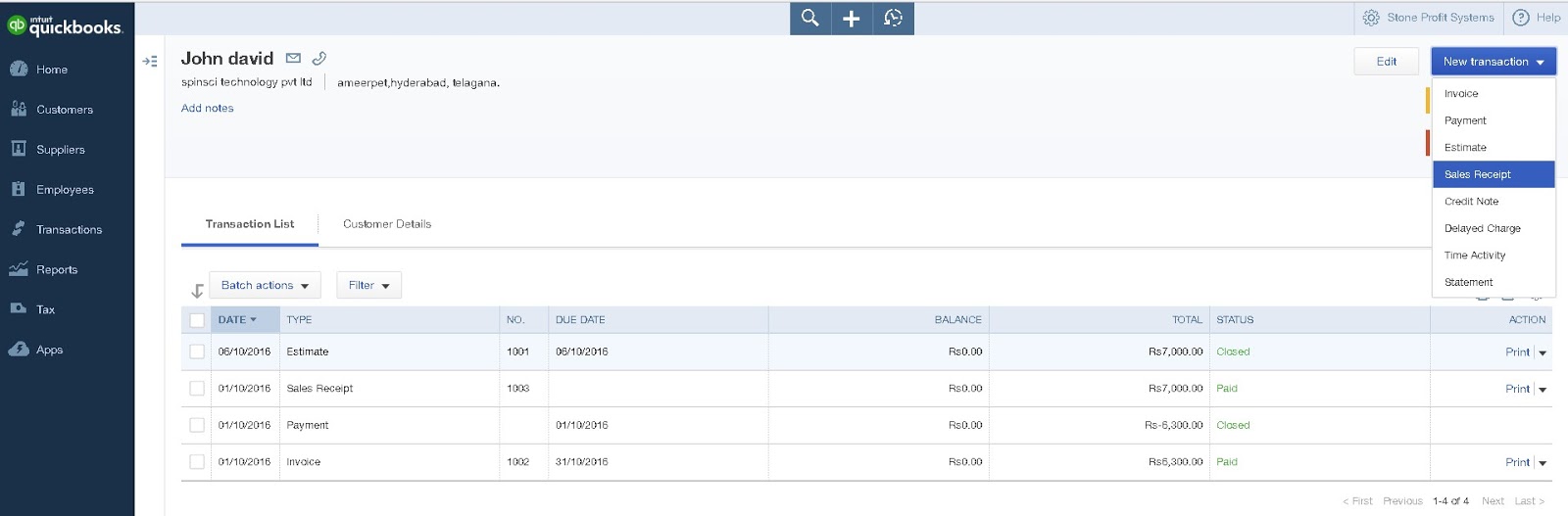

- Artificial Accounts : The things which are related to the organisations,lands,etc called as artificial accounts.

- Examples :Pvt ltd companies,LLc's,LLP's,etc.

Debit:Receiver.

Credit:Giver.

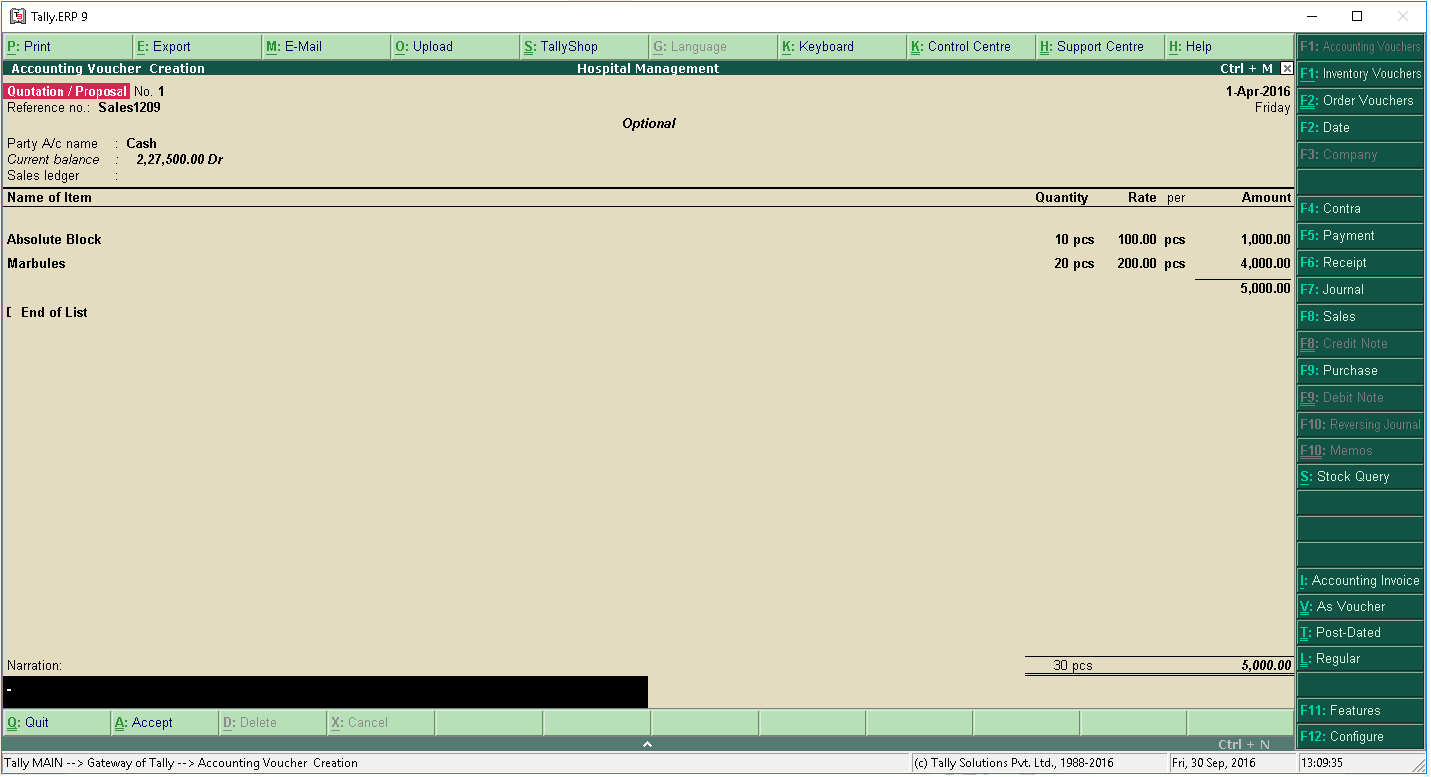

Nominal Accounts:

- The accounts which are related to the money(incomes/gains and expenses/losses) called 'Nominal Accounts'.

- Income / Gain :The amount which comes into the organisastion is called income.

- Expenses / losses :The amount which goes out from the organisation is called expenses.

Debit :Expenses / losses.

Credit :income / gains.